What is Intraday Trading?

ACP is designed to redefine the way that you chart and analyze the financial markets, with more technical tools and capabilities than ever before. Real time Insights: When using a tick chart trading strategy, traders have immediate accessibility to information about the swift market swings, facilitating quick actions regarding changing circumstances as well as improving decision making. You’ll get two new stock picks every month, plus 10 starter stocks and best buys now. It shows how high prices reached above the opening and closing prices while the lower wick extends from the bottom of the body to the lowest price of that time period. We’ll begin by breaking down and defining the two styles themselves. Contracts for difference CFD are leveraged products and carry a high level of risk to your capital as prices may move rapidly against you. You might be perfectly fine using a crypto exchange that only trades a few coins. This pattern suggests a potential shift in market sentiment from bearish to bullish. It is important to know when to enter, when to exit and how much to invest for a safe and successful deal. Interactive Brokers apps gallery. Copy trading has also become popular, enabling traders who do not have time to follow markets, or create a strategy, to participate by copying others. When a market’s open and close are almost at the same price point, the candlestick resembles a cross or plus sign – traders should look out for a short to non existent body, with wicks of varying length. In addition, Bajaj Financial Securities Limited is not a registered investment adviser under the U. Iii Capital work in progress. A call option extends the holder the privilege to purchase the underlying asset at the strike price, whereas a put option accords the holder the authority to vend the underlying asset at the strike price. CIR/ MIRSD/ 16/ 2011 dated August 22, 2011 and the Rules, Regulations, Bye laws, Rights and Obligation, Guidelines, circulars issued by SEBI and Exchanges from time to time. According to a study by Cheol Ho Park and Scott H. For example, potential support at the 50% Fibonacci level occurs if a trader identifies a previous uptrend and measures a retracement of 50%. Investing with margin accounts means using leverage, which increases the chance of magnifying an investor’s profits and losses. Com has some data verified by industry participants, it can vary from time to time. This is the moment you realize that the problem is not the system, but that in the financial market you don’t need all the tools that you have read.

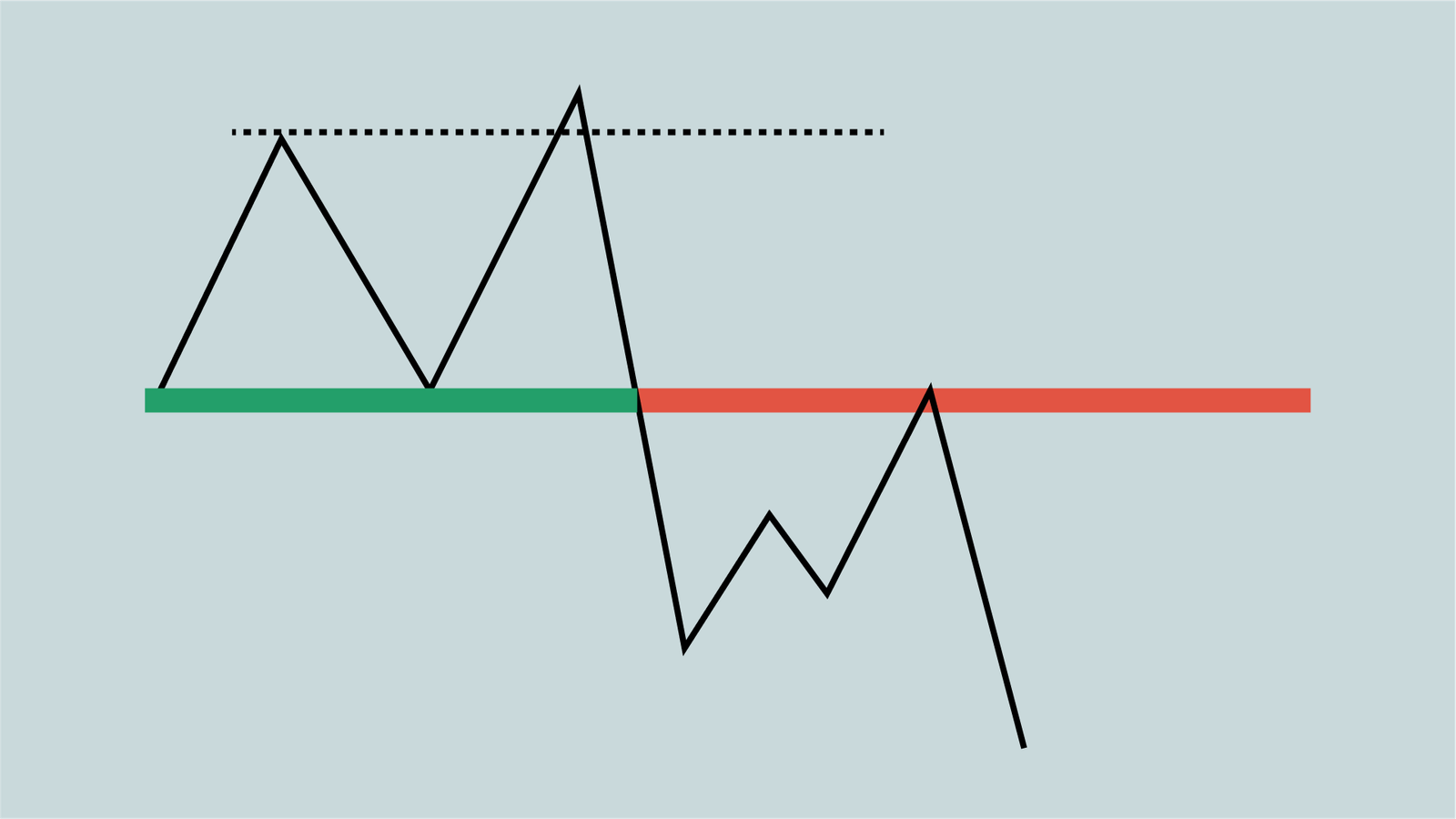

Trading Strategies with the M Pattern

5 million by using non public material information about Livedoor, a financial services company that was planning to acquire a 5% stake in Nippon Broadcasting. You can update your choices at any time in your settings. Company and product updates. The opposite pattern, the Inverse Head and Shoulders, therefore forms after a downtrend and marks the end of. Investing involves po-broker-in.site risk and the potential to lose principal. Start investing with Tiger Trade. Begin with identifying a liquid share that has clear price fluctuations and trends;. The agricultural revolution. Plus500 stands out as a leading CFD broker in the UK, especially for active traders. EToro stands out for its user friendly interface and social trading features, making it an excellent choice for beginners. In the Indian stock market, tick size plays a crucial role in determining price movements and trading strategies. The other most famous stock market exchange is the SandP BSE Sensex, managed by the Bombay Stock Exchange BSE. Later in his career, Markowitz helped Ed Thorp and Michael Goodkin, two fund managers, use computers for arbitrage for the first time. In normal circumstances, yes, the money is safe. Concepts explained in an easy to understand style. Merrill Edge® Self Directed is a great option to consider not only for users of Bank of America which it is a part of, but also those who are looking to invest and bank under one roof and with a highly capable app. Research the options available and choose the one that best fits your needs. 7 The paper looked at whether the CBCA insider trading provisions were still needed and, if so, what changes could be made. While these forms of education are crucial, they cannot prepare you for every situation you will face when day trading. Volatile market swings can trigger big margin calls on short notice. Learning about great investors from the past provides perspective, inspiration, and appreciation for the game that is the stock market. Next, you need to gain approval for options trading, proving your market savvy and financial preparedness to the brokers. US Cash Indexes since 1998 from tick to daily resolution bars on NDX, SPX, and VIX. This usually involves disclosing your financial situation, trading experience, and understanding of the risks involved. Swing trading is a strategy aimed at gaining profit from stock price fluctuations over a period of several days to weeks. Online brokers are sometimes referred to as discount brokers because they offer a considerable discount to what the typical full service brokerage firm charges. Graham’s most well known disciple is Warren Buffet. While they share some similarities, they also differ in various ways. India boasts a diverse range of trading platforms designed for both novice and experienced investors. She is a Today Show and Publisher’s Weekly featured author who has written or ghostwritten 10+ books on a wide variety of topics, ranging from day trading to unicorns to plant care.

What Is Day Trading?

To make this more fun, look at trading as a money game in which if you play by the rules and have a knack for spotting market patterns, you can win big time. Investors of all levels can benefit from Merrill’s wide range of resources and on hand customer service support. The following is listed as examples of what this may be. Desktop platform has a steep learning curve. Already have a Full Immersion membership. Then you should choose the right broker. Risk is a two edged sword, meaning it can harm you as much as it can help you. It consists of two distinct lows at approximately the same price level, separated by a peak. CNBC is a beginner friendly channel, while Bloomberg is oriented more toward professionals. This reporting shall be to FI’s stock exchange information database, which is Sweden’s “officially appointed mechanism” in accordance with the Transparency Directive. Below is an example to help you understand how trading works. It also provides a number of trade signals. Measure advertising performance. Take your learning and productivity to the next level with our Premium Templates.

We Care About Your Privacy

The three black crows candlestick pattern is formed when the market makes three consecutive bearish candles with lower lows. Comment: As traders, the most important step we need to do is to preserve our trading capital at all times. Options, also called vanilla options, have a payout that is dependent on the difference of the strike price of the option and the price of the underlying asset on one side of the strike price while fixed on the other. Each of our forex trading platforms can be personalized to suit your trading style and preferences with personalized alerts, interactive charts and risk management tools. You should identify whether you are an intraday or a middle term trader or represent a combination of these two types. AMP Futures offers you 50+ Trading Platforms. The downside on a long call is a total loss of your investment, $100 in this example. Identifying the highest potential options trades.

Call options example

Traders can extract meaningful guidance from disciplined trading quotes, learning how to adapt their strategies in response to the dynamic and often unpredictable nature of the markets. The six categories we tested were. The pattern suggests that the bears have taken charge of the market and indicate a possible decline in price in the near future, so traders look for shorting opportunities. They are a fundamental technical analysis technique that helps traders use past price actions as a guide for potential future market movements. The trading account format PDF is an effective and powerful tool for identifying areas where cost reduction is possible. Tharp’s “Trade Your Way to Financial Freedom” is a holistic guide that shows traders how to create a personalised trading plan. Residents are subject to country specific restrictions. You must enter the OTP that was received from the trading app to your registered cellphone number after providing all the necessary information. The Three Outside Down pattern starts with a bullish candle. Several mobile apps allow you to practice stock trading without risking real money — also called paper trading. Marketing partnerships. That said, automated trading usually refers to automation of manual trading through stops and limits, which will automatically close out your positions when they reach a certain level, regardless of whether you are at your trading platform or not. A lower strike price has more intrinsic value for call options since the options contract lets you buy the stock at a lower price than what it’s trading for right now. As far as patterns are concerned, the ascending and descending triangles are considered to be the best. This can increase your chances of a successful trade and minimize the risk of false breakouts. The call option writer faces infinite risk if the stock’s price rises and are forced to buy shares at a high price. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by Bajaj Financial Securities Limited, including the products and services described herein are not available to or intended for U. Developing trading psychology is essential for beginners who want to succeed in the currency/stock market. We’d also like to use analytics cookies so we can understand how you use our services and to make improvements. Then look no further. Options are easier to access, with the best online brokers offering them — and some even allow clients to trade them for no commission. Bajaj Financial Securities Limited is engaged in the business of Stock Broking and as a Depository Participant. It’s generally preferred by short term traders as positions have no fixed expiry date, and the spread is relatively low. The downside of a short put is the total value of the underlying stock minus the premium received, and that would happen if the stock went to zero. These are a group or combination of individual shares, which could be a group of companies in a similar industry, such as electric vehicles, or a group of large successful companies such as the top 100 companies in the UK FTSE 100. Figures for the previous reporting period.

I’m an NRI How should I Invest in Indian Stocks?

This certification is particularly relevant for those interested in trading, market analysis, and portfolio management based on market trends. Don’t have an account. The market trades from 9:00 AM to 11:30 PM during summers and 11:55 PM during summer. Account Maintenance Charge. In their paper, the IBM team wrote that the financial impact of their results showing MGD and ZIP outperforming human traders “. FI may refrain from intervening if the infringement is minor or excusable, the person in question rectifies the matter, if there are other special grounds or if some other body has taken action against the person and this action is deemed sufficient. Many times we have seen that new investors or traders tend to dig into a toolbox whenever a new widget arrives in the market or whenever they find something really mesmerizing. Buy BTC, ETH, and other crypto easily. The indicator is a series of dots placed above or below the price bars. Robert Greifeld, NASDAQ CEO, April 2011. The essential elements of scalping trading. To determine the best approach for your specific investment goals, speaking with a reputable fiduciary investment advisor is recommended. Once you open trading on a Forex platform, they provide you with a bunch of helpful tools to understand how trading works in an easy way. We are thrilled to announce our exciting partnership with TradingView, a leading platform in the world of financial analysis and trading. The ones we’ve listed have something for every type of trader. If the EUR interest rate was lower than the USD rate, the trader would be debited at rollover. Paxos is not an NFA member and is not subject to the NFA’s regulatory oversight and examinations. You buy shares of stock, then hold them for years and years. Stock trading is a tricky business. NSE trading holidays are observed on both Saturdays and Sundays. To make it easier for investors and traders to buy shares, companies can opt to have their shares listed on a stock exchange. Global stock investors will find a very friendly experience on the Global Trader app. So make sure that any app you sign up to has the assets you want to trade in the first place. Store and/or access information on a device. Positions are unaffected by risk from overnight news or off hours broker moves. During most trading days, these two will develop disparity in the pricing between the two of them. The thing that I like the most about this book is that is shows us that we have to be ready to adapt to change.

This is Next Kraftwerke

ETRADE won StockBrokers. I wouldn’t say I’m confident in my ability, but I can tell that I’ve been getting steadily better over time in terms of risk management, reading patterns, adjusting when things don’t go my way. Futures contracts have this obligation. Once you’ve registered and fully verified your account, it’s time to begin trading. Kindle edition: Buy it nowHardcover edition: Buy it now. Follow top performing paper traders and learn from others’ ideas. It eliminates the need for human intervention and emotions, which can often lead to costly mistakes. Was this page helpful. These disclosures contain information on Robinhood Financial’s lending policies, interest charges, and the risks associated with margin accounts. Each time you log in to the thinkorswim platform, you can toggle between “Live Trading” or “paperMoney. EToro does not approve or endorse any of the trading accounts customers may choose to copy or follow. A reminder for traders to keep their minds focused on risk and their circle of competence. There are hundreds of technical indicators in the market.

Options Trading 101 The Ultimate Beginners Guide To Options

Even these traders must pay some attention to additional factors beyond the current price, as the volume of trading and the periods used to establish levels all impact the likelihood of their interpretations being accurate. I agree to terms and conditions. Bokus har sålt böcker online sedan 1997. Money management detaches you from your trades, which means that you are unconcerned with your trade’s outcome as it is based purely on your trading system and risk management techniques. Cryptocurrencies are particularly volatile and can drop at any point; therefore, investors are advised to take caution when using leverage as part of their trading strategy, as this could lead to significant losses. Babypips helps new traders learn about the forex and crypto markets without falling asleep. The platform is packed to the brim with scores of features, like its unique Gemini Earn program for earning interest on crypto holdings and the Gemini Credit Card. Below $20, the long put offsets the decline in the stock dollar for dollar. Often, you will want to sell an asset when there is decreased interest in the stock as indicated by the ECN/Level 2 and volume. With its robust features and reliable performance, Binance. It is essential to cultivate methods for coping with stress to preserve robust trading psychology and execute successful trading strategies efficiently. If the stock does fall, the long put offsets the decline. There are much easier, less risky options to earn money by investing. To start trading, you can open a demo or live account with us, which will give you access to the various markets in the risk free or live environment, respectfully. These criteria are developed by analyzing factors such as revenue growth and profitability. It empowers them to make informed decisions about where to allocate their money, how to diversify their investments to mitigate risk, and potentially grow their wealth over time through sound investment choices. Another big difference between the two is the types of margin offered to day traders and swing traders. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. Candlestick patterns can tell you a lot of information. If the seller does not own the stock when the option is exercised, they are obligated to purchase the stock in the market at the prevailing market price. Was this page helpful. Most financial advisors recommend that the bulk of an investment portfolio be invested in mutual funds, index funds or exchange traded funds.

COURSES

Overall, CMC Markets simply delivers an excellent mobile trading experience. By systematically guiding users based on their preferences and learning goals, it ensures that individuals don’t feel lost or overwhelmed. Futures assets and PandL. Your ability to open a trading business with Real Trading™ or join one of our trading businesses is subject to the laws and regulations in force in your jurisdiction. 24% on balances up to $100,000, as of June 2024. This market condition is usually flagged as oversold. Additionally, the exchange announces specific holidays throughout the year when trading is suspended. Adjustments:1 The Closing Stock is valued at ₹ 15,400.

Customizable Dashboard

Position traders ignore short term price movements and prefer to rely on more precise fundamental analysis and long term trends. 0 web platform offers market watch, advanced charting with over 100 indicators, and advanced order types like cover order and good till triggered GTT order, along with fast order placements and other features. If you are having an issue with an opened ticket with our Customer Service feel free to contact us via Facebook or Twitter via DM so we can escalate your case to the relevant team. Many let a losing trade continue in the hope that the market will reverse and turn that loss into a profit. Plus, you’ll also need to be familiar with what moves the forex market – like central bank announcements, news reports and market sentiment – and take steps to manage your risk accordingly. This options trading strategy is the flip side of the long put, but here the trader sells a put — referred to as “going short” a put — and expects the stock price to be above the strike price by expiration. Availability varies by app, so it’s important to check each platform’s offerings. However, note that our margin policy doesn’t guarantee against your capital running into a negative balance, depending on region and account type retail or professional. Saxo also offers excellent trading technology. For example, cash account, accounts receivable, the value of stock in hand, etc. Securities products and investment advisory services offered by Morgan Stanley Smith Barney LLC, Member SIPC and a Registered Investment Adviser. Underlying Closing Price. Steven Hatzakis is the Global Director of Research for ForexBrokers. Lastly, you may enter the short position if the price exceeds the support neckline if the price breaks the support line. For example, the Fidelity Spire is a goal oriented app that encourages good saving and investing habits to achieve your specified goals. Different markets have varying tick sizes to reflect their unique trading characteristics and regulatory requirements. Options on swaps, and interest rate cap and floors effectively options on the interest rate various short rate models have been developed applicable, in fact, to interest rate derivatives generally. While intraday trading refers to the buying and selling shares on the same day, regular trading does not have such time constraints. Position trading generally involves the utilization of both fundamental and technical analyses. It’s important to note that most credit card providers do not support crypto purchases. What is a common misconception about investing. Add money to your trading wallet and withdraw anytime. Formally, when paper share certificates were rampant, the stock exchanges would use an open outcry method. Forex trading providers deal with the banks on your behalf, finding the best available prices and adding on their own market spread. He’s recognized the traps often over the years and explains them well in this thread. ₹0 AMC on Demat account. You now have Rs 1 crore cash in your portfolio account and a Rs 1 crore intraday trading limit. Requirement to File Reports. The increase in turnover is due to a number of factors: the growing importance of foreign exchange as an asset class, the increased trading activity of high frequency traders, and the emergence of retail investors as an important market segment.

Categories

It involves identifying the stocks or assets that are experiencing strong upward or downward momentum and capitalising on these trends. If you trade CFDs on equities, then losses, amplified by the leverage associated with these products, can have a significant impact on capital. Well maybe you shouldn’t be trading if you need an idiot proof app. “The Cross Section of Speculator Skill: Evidence from Day Trading. EToro has grown to be one of the largest and most creative players in the world of CFD trading. It looks like this on your charts. Drawing in more trendlines may provide more signals and may also give greater insight into the changing market dynamics. Options trading entails significant risk and isn’t appropriate for all investors. Intraday Trading Indicator: When it comes to booking profits in intraday trading, you must conduct an extensive study. Follow individual stocks and financial news while observing how markets fluctuate. This involves a lower outlay of premium than a straddle but also requires the stock to move either higher to the upside or lower to the downside to be profitable. Internet day trading scams have lured amateurs by promising enormous returns in a short period. These terms are synonymous, and all refer to the forex market. Actually, let’s try this very idea on the SP500 cash index.